home

When will the U.S.-China trade war end?

Was the trade war that President Trump started with China in 2018 a surprise, or was it anticipated? Once the trade war began, how long was it expected to last, and how did these expectations shift when Joe Biden became president? In our recent Journal of International Economics article “Trade War and Peace: U.S.-China Trade and Tariff Risk from 2015-2050,” George Alessandria, Shafaat Khan, Armen Khederlarian, Kim Ruhl, and I use the dynamics of U.S. imports in the period around the U.S.-China trade war and a model of exporter dynamics to estimate the time-varying probability of switching between trade peace (a.k.a. Normal Trade Relations) and trade war. We find that the trade war was initially expected to end quickly, but its expected duration grew substantially after 2020. Strikingly, this implies that the expected mean future U.S. tariff on China rose more under President Biden than under President Trump.

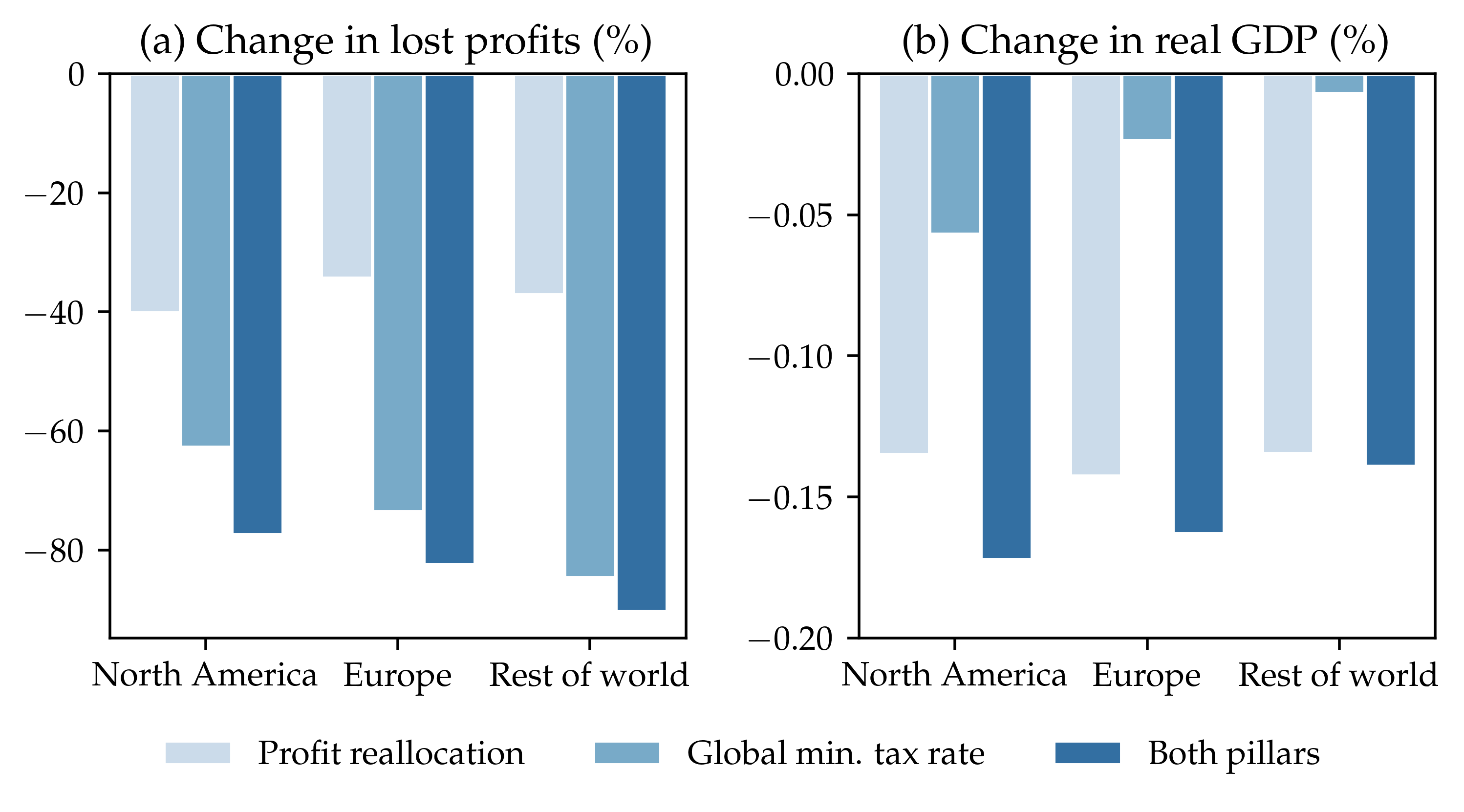

How would regulating multinational profit shifting affect the economy?

Multinational enterprises (MNEs) shift large portions of their profits to tax havens like Ireland and Bermuda, costing governments in their home countries hundreds of billions of dollars per year in tax revenue. The OECD and G20 governments have recently agreed upon a historic international policy framework designed to reduce profit shifting, which will impose a 15% global minimum corporate tax rate and reallocate the right to tax 25% of MNEs' profits to the countries in which they sell their products. In our recent Journal of International Economics article “A Macroeconomic Perspective on Taxing Multinational Enterprises,” Sebastian Dyrda, Guangbin Hong, and I argue that this framework will achieve its goal, but it will also reduce MNEs' incentives to invest in intangible capital, which will cause the global economy to shrink.

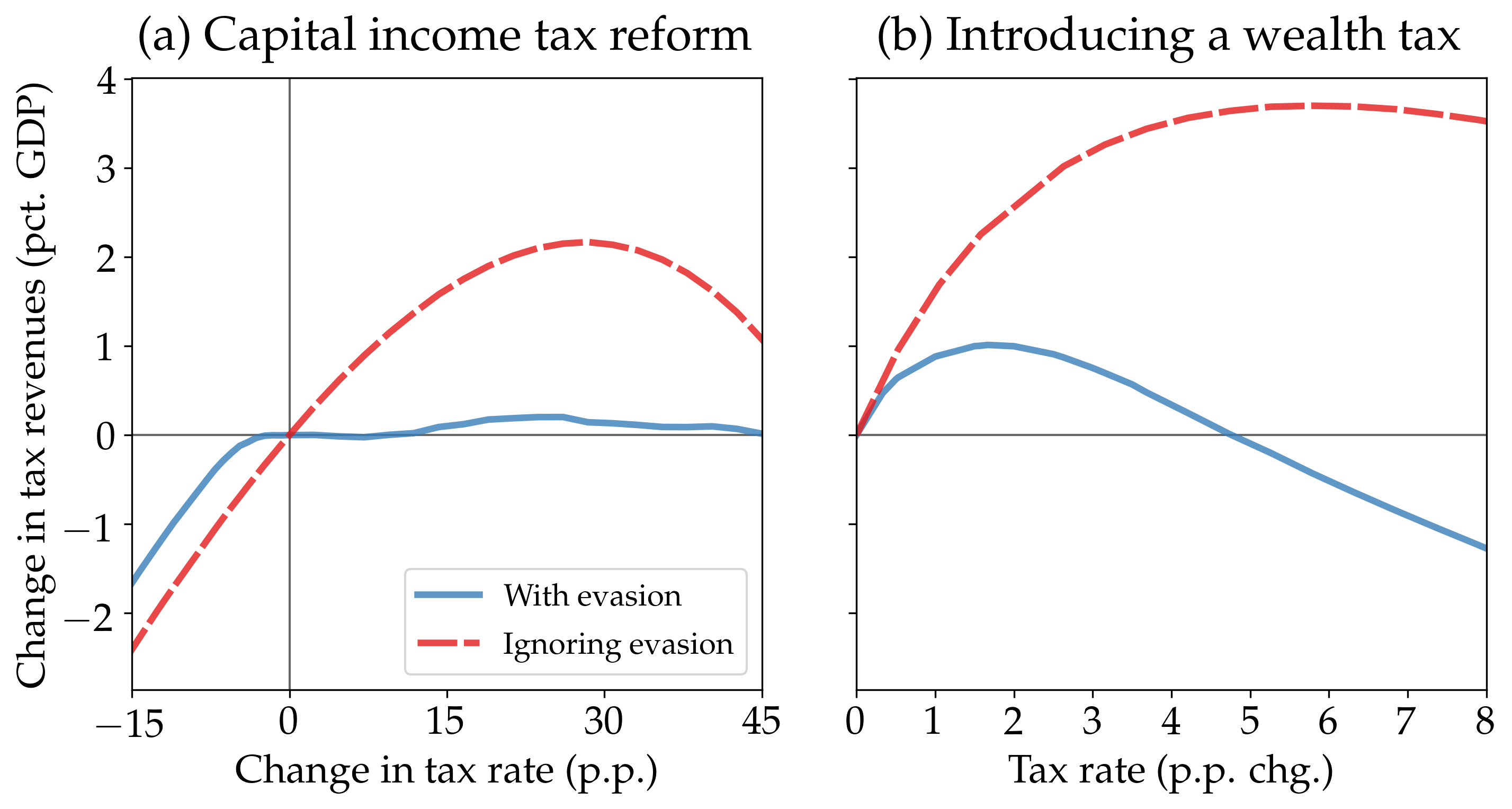

How would tax evasion shape the effects of higher capital taxes?

Rising wealth inequality is evoking calls to tax capital more heavily, but concerns abound that the wealthy would respond by concealing more of their assets offshore. In our Journal of Political Economy article “Tax Evasion and Capital Taxation,”, Shahar Rotberg and I build a general equilibrium model of offshore tax evasion to analyze how these policies would affect the economy. But for evasion, raising capital income taxes and taxing wealth would reduce inequality and could increase tax revenue substantially. In reality, however, inequality would rise and tax revenues would rise modestly or even fall.

About me

I am a professor in the University of Toronto economics department and an NBER Research Associate in the IFM program. I hold a B.A. in mathematical economics from Pomona College and a Ph.D. in economics from the University of Minnesota. I do quantitative research at the intersection of macro and trade. Recent topics include the macroeconomic consequences of offshore tax evasion by the ultra-rich and international profit shifting by multinational enterprises, and the dynamics of U.S. trade policy towards China in the past, present, and future. I am an Associate Editor at the Journal of International Economics.

Contact information:

150 St. George St., Toronto, ON M5S 3G7

www.joesteinberg.com

joseph.steinberg@utoronto.ca

Google Scholar | IDEAS | GitHub | Twitter